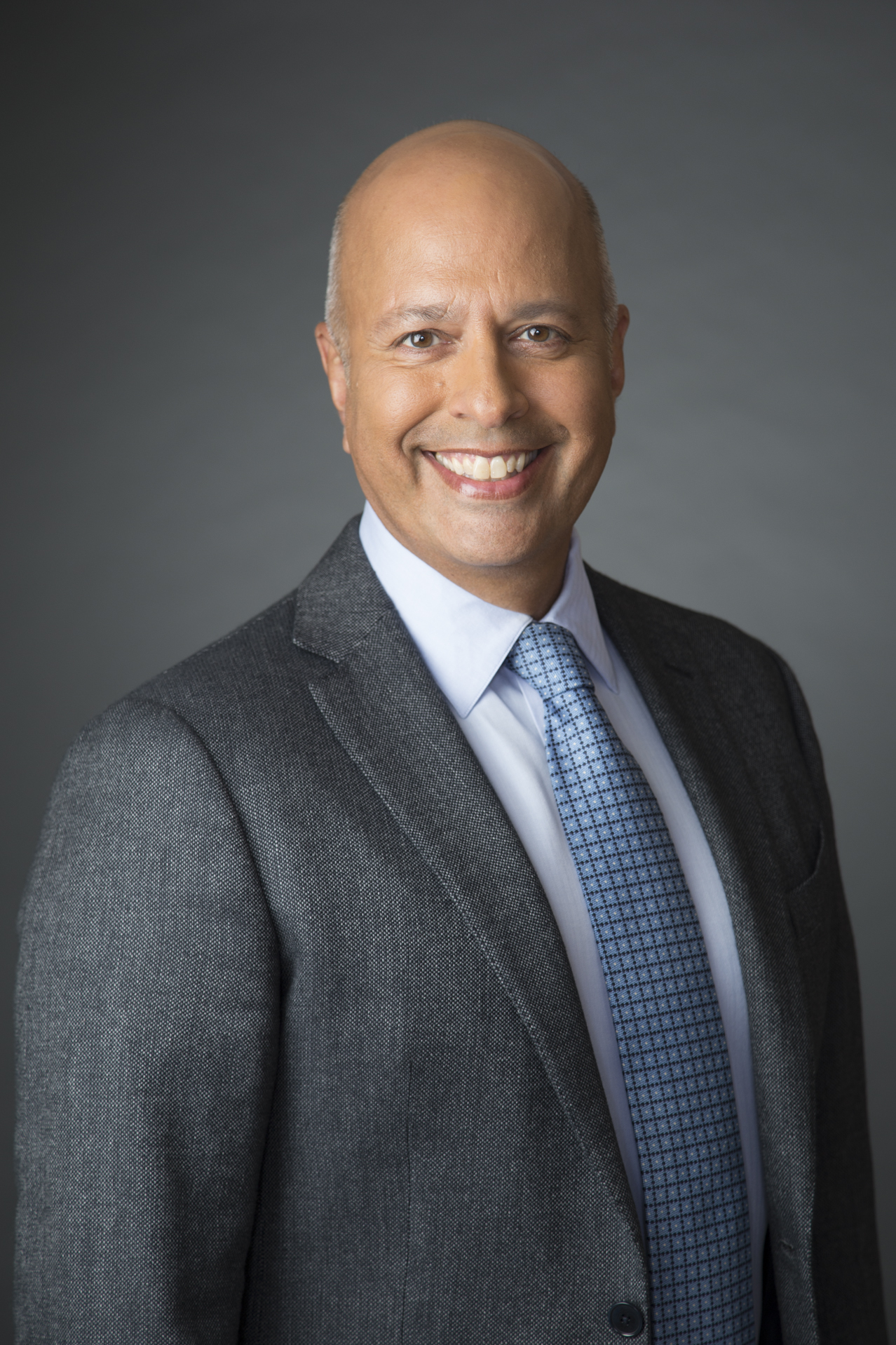

About Erik Townsend

Erik Townsend is a retired software entrepreneur turned hedge fund manager. Throughout his career, Erik has capitalized on his ability to understand complex systems and anticipate paradigm shifts far in advance of the mainstream. Read More...

Erik: Joining me now is Lyn Alden, founder of Lyn Alden Investment Strategy and best selling author of Broken Money. Lyn, it's great to have you back, you've written a terrific book. It bears a lot in similar to my book with one very subtle distinction, which is nobody read my book. And you're not only on the best selling list, but you're at the top of it. Number one best seller, and an absolutely fabulous book, I want to add my personal endorsement to it. I don't mind saying that when I wrote my book, I just wanted to get what was on my mind about my predictions about Bitcoin and central bank digital currencies off my chest. In your case, you did a much more comprehensive job. You did the job on this book that I probably should have done on mine. So congratulations for all of the well deserved praise that it's received. I want to start though with why you did this. You wrote a book called Broken Money, obviously, you think the money system is broken. You did this at a time that the world is contemplating what digital currency means both private label and central bank issued digital currency. What's the backstory? Why was this the time to write a book about the money system being broken?

Lyn: Yeah, so first of all, thank you for having me on. Always happy to be here, and I appreciate your support of the book. That certainly means a lot. One of the advice I give people is don't write a book unless you feel like you have to. Because for people that work in our kind of industry, it's going to be a massive time sink, it's going to take a lot of time, it's not a good ROI. If you're thinking just have you know, the money, it's really about, you have ideas in your head that you just feel like are best in book form. And it's calling to you at the moment. And so I had written a lot of content over the past five plus years on multiple subjects based around money, energy, the structure of markets, you know, Bitcoin, stablecoins, CBDCs, inflation, that whole gamut. And I felt that there were some frameworks that were kind of important enough that a whole book would be useful for them. And essentially, you can walk the reader through from first principles, how did we get here? What's going on. And I felt like there's just not a lot of focus on how technology changes. How we use money, both in history and the present, and some of the underlying structures for how the system works. So I generally find that when I get questions from people, you know, they read one of my long form articles, but they don't necessarily read like, you know, the past five long form articles. And sometimes there's ones that feed right into another one and ones that don't. So I figured putting them in a book form is kind of like basically guiding the reader through this more chronological order of things. And I felt that money is a complex enough subject and it's also poorly understood. And it's really one of those that I think deserves a full book treatment.

Erik: Joining me now is ECRI co-founder Lakshman Achuthan. Lak prepared a slide deck to accompany this week's interview. You'll find the download link in your research roundup email. If you don't have a research roundup email, just go to our homepage macrovoices.com. Look for the red button above Lak's picture that says looking for the downloads. Lak two times ago that I last interviewed you was more than a year ago. I think it was last July. We had you back on in February and I want to kind of pick up that conversation because two interviews ago you had just put on I think your recession call saying recession coming. When I interviewed you in February of this year. You reconfirm that and said, yeah, it took a little longer than expected, still coming. So I made a mental note to myself, let's wait this out six months, if it hasn't happened yet, we got to get you back on to figure out what's happening. It's been six months, is the recession that everybody's predicting still coming?

Lakshman: Yeah, I think so if in fact, it's not already here. It's, it's unusual for everybody to see a recession when it's starting. That would be really weird. Typically, people recognize recessions in the rearview mirror, ourselves included, because the indicators that define recession, output, employment, income, and sales, those all undergo a great deal of revision in the vicinity of recessions. And those revisions occur well after the fact. So you can have an instance where you're inside of a recession. And you've never seen, for example, a negative GDP, or a negative jobs growth. In the last recession, the Great Recession of 07-09, the first time we saw a negative GDP number....

MACRO VOICES is presented for informational and entertainment purposes only. The information presented in MACRO VOICES should NOT be construed as investment advice. Always consult a licensed investment professional before making important investment decisions. The opinions expressed on MACRO VOICES are those of the participants. MACRO VOICES, its producers, and hosts Erik Townsend and Patrick Ceresna shall NOT be liable for losses resulting from investment decisions based on information or viewpoints presented on MACRO VOICES.