Macro Voices Podcasts

Subcategories

MACRO VOICES is presented for informational and entertainment purposes only. The information presented in MACRO VOICES should NOT be construed as investment advice. Always consult a licensed investment professional before making important investment decisions. The opinions expressed on MACRO VOICES are those of the participants. MACRO VOICES, its producers, and hosts Erik Townsend and Patrick Ceresna shall NOT be liable for losses resulting from investment decisions based on information or viewpoints presented on MACRO VOICES.

Erik Townsend welcomes Jeffrey Christian to MacroVoices. Erik and Jeff discuss:

Erik Townsend welcomes Jeffrey Christian to MacroVoices. Erik and Jeff discuss: Erik Townsend welcomes Art Berman to MacroVoices. Erik and Art discuss:

Erik Townsend welcomes Art Berman to MacroVoices. Erik and Art discuss: Erik Townsend welcomes Grant Williams to MacroVoices. Erik and Grant discuss:

Erik Townsend welcomes Grant Williams to MacroVoices. Erik and Grant discuss: Erik Townsend welcomes Louis-Vincent Gave to MacroVoices. Erik and Louis discuss:

Erik Townsend welcomes Louis-Vincent Gave to MacroVoices. Erik and Louis discuss:

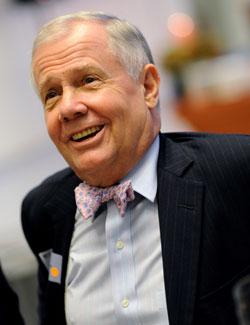

Erik Townsend welcomes Jim Rogers back to MacroVoices. Erik and Jim discuss:

Erik Townsend welcomes Jim Rogers back to MacroVoices. Erik and Jim discuss: Erik Townsend welcomes Jack Schwager to MacroVoices. Erik and Jack discuss:

Erik Townsend welcomes Jack Schwager to MacroVoices. Erik and Jack discuss: Erik Townsend welcomes David Rosenberg to MacroVoices. Erik and David discuss:

Erik Townsend welcomes David Rosenberg to MacroVoices. Erik and David discuss:

Erik Townsend welcomes back Rick Rule from Sprott Global to MacroVoices. Erik and Rick discuss:

Erik Townsend welcomes back Rick Rule from Sprott Global to MacroVoices. Erik and Rick discuss: Erik Townsend welcomes David Hay to MacroVoices. Erik and David discuss:

Erik Townsend welcomes David Hay to MacroVoices. Erik and David discuss: An interview which was originally aired on June 2, 2016, between Raoul Pal of Real Vision and Edward Misrahi, Goldman Sachs alumni and founder of Eton Park.

An interview which was originally aired on June 2, 2016, between Raoul Pal of Real Vision and Edward Misrahi, Goldman Sachs alumni and founder of Eton Park. Erik Townsend and Aaron Chan introduce the Accredited Investor Academy Series, Part 4. We’re taking this week off from our regular show format, so instead of a featured interview guest, we’re airing the final part of a four-part series about learning to be a sophisticated private investor.

Erik Townsend and Aaron Chan introduce the Accredited Investor Academy Series, Part 4. We’re taking this week off from our regular show format, so instead of a featured interview guest, we’re airing the final part of a four-part series about learning to be a sophisticated private investor. Erik Townsend and Aaron Chan introduce the Accredited Investor Academy Series, Part 3A. We’re taking this week off from our regular show format, so instead of a featured interview guest, we’re airing the third of a four-part series about learning to be a sophisticated private investor.

Erik Townsend and Aaron Chan introduce the Accredited Investor Academy Series, Part 3A. We’re taking this week off from our regular show format, so instead of a featured interview guest, we’re airing the third of a four-part series about learning to be a sophisticated private investor. Erik Townsend and Aaron Chan welcome Julian Brigden to MacroVoices. Erik and Julian discuss:

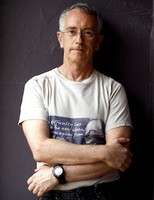

Erik Townsend and Aaron Chan welcome Julian Brigden to MacroVoices. Erik and Julian discuss: Erik Townsend and Aaron Chan welcome Professor Steve Keen to MacroVoices. Erik and Professor Keen discuss:

Erik Townsend and Aaron Chan welcome Professor Steve Keen to MacroVoices. Erik and Professor Keen discuss: